STAY INVESTED

OUT OF TROUBLE

WORRY LESS

THE PROBLEM

Staying invested but worry

about market

OUR SOLUTION

We

hedge

opportunistically

INVESTING PROCESS ▶ ENHANCED

OUR VALUE ADDED

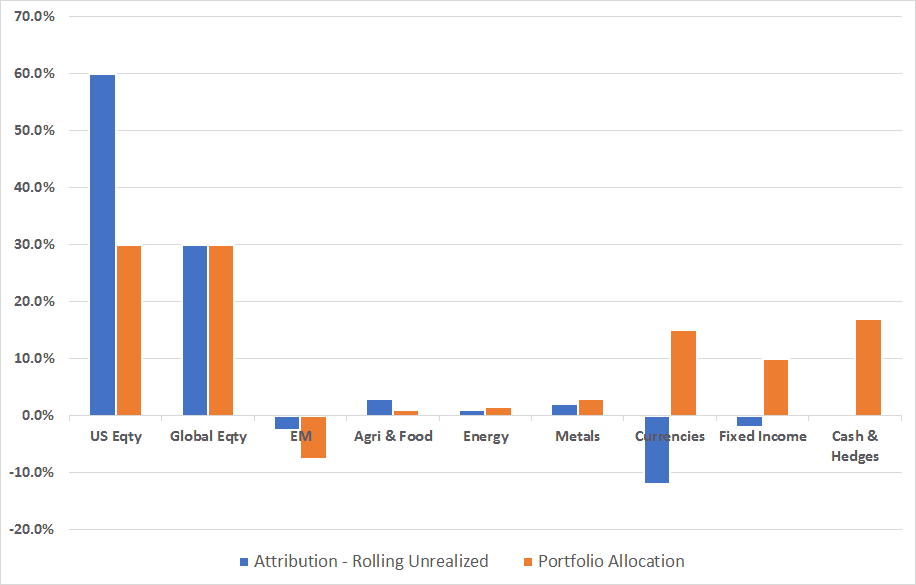

1. ASSET ALLOCATION

Most advisors stop here.

Using our "Investing Best Practices" we will build a globally diversified portfolio designed to:

- Reach your goals

- Within your risk tolerance and

- Time frame

Then the

hard work

begins...

2. HEDGE STRATEGY

A twelve step “risk thermostat” proprietary program modulates as the equity market bull/bear cycle progresses and hedges when most advantageous.

As the economic tides shift, we transition holdings to capitalize on both Bull and Bear environments, thus providing a worry free, all-weather solution for the long-term.

- Call writes are used as a first layer of hedging after parabolic moves

- S&P Puts are then added during waning momentum

- Lastly other long term tactics employed should a bear market develop

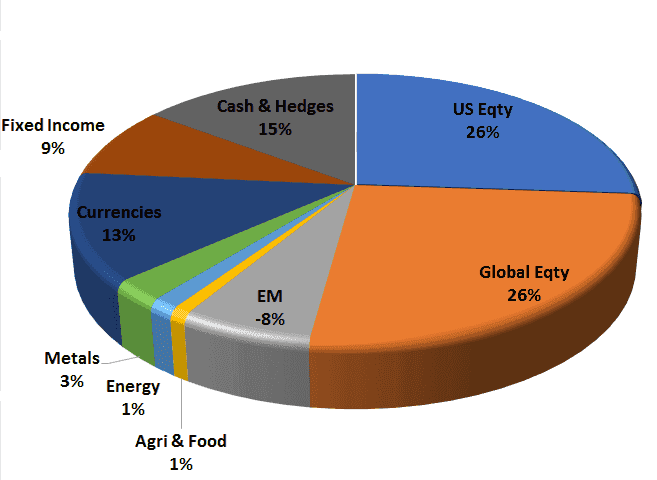

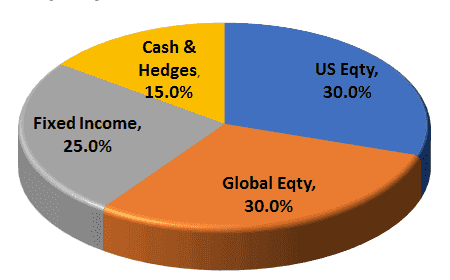

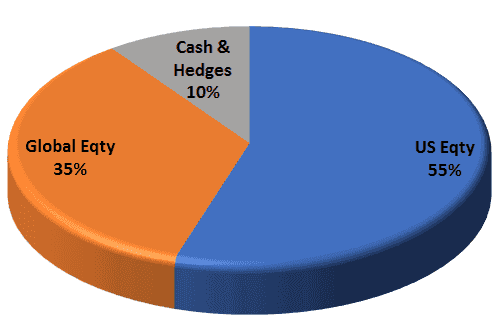

INVESTMENT PORTFOLIOS

Managed on your behalf, we offer key portfolios that are fully scalable to satisfy your needs. All contain our Dynamic Hedge Strategy.

Diversified Portfolios + Hedge

Strategy = Smarter Investing