HOW MOST

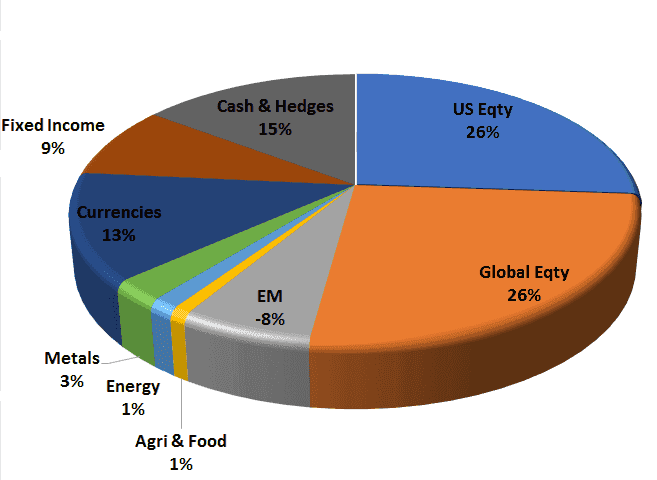

dEAL With RISK

1.TIME

RIDING OUT STORM

2.DIVERSIFICATION

mostly BONDS

hALLMARKS OF INVESTING

WE EMBRACE BUT A problem…

This leaves you exposed!

The numbers you need to know

-40%

Bear Market Average

4 Years

Time to Breakeven of average Bear Market

60/40

2009: Took 3 years to breakeven with typical 60% stock/40% bond diversified portfolio

1%

Possible Bond efficacy loss due to low interest rates & high inflation

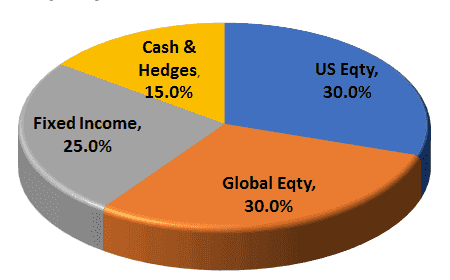

1. ASSET ALLOCATION

Most advisors stop here.

Using our "Investing Best Practices" we will build a globally diversified portfolio designed to:

- Reach your goals

- Within your risk tolerance and

- Time frame

Then the

hard work

begins...

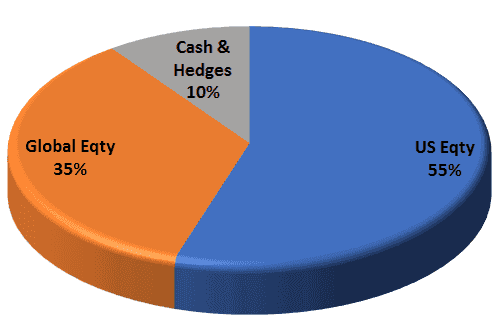

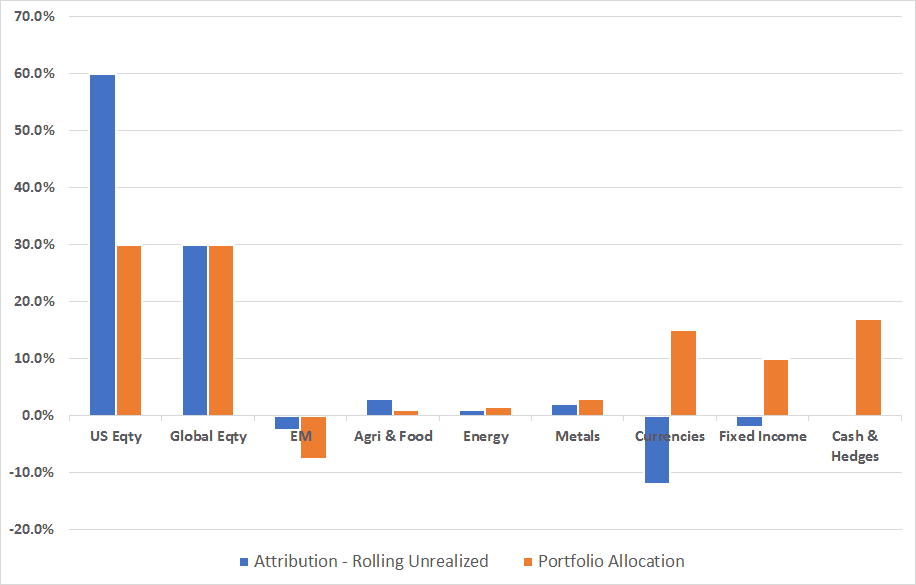

2. HEDGE STRATEGY

A twelve step “risk thermostat” proprietary program modulates as the equity market bull/bear cycle progresses and hedges when most advantageous.

As the economic tides shift, we transition holdings to capitalize on both Bull and Bear environments, thus providing a worry free, all-weather solution for the long-term.

- Call writes are used as a first layer of hedging after parabolic moves

- S&P Puts are then added during waning momentum

- Lastly other long term tactics employed should a bear market develop

Convert Problem of Drawdowns

Into Opportunity