☑STAY INVESTED

☑OUT OF TROUBLE

☑WORRY LESS

THE PROBLEM

Market damage while staying invested

SOLUTION

Tactically hedge downside

INVESTING PROCESS ▶ ENHANCED

OUR VALUE ADDED

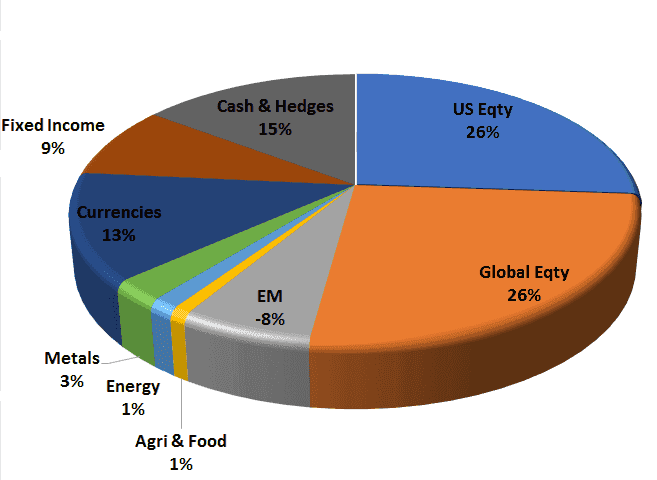

1. CUSTOM PORTFOLIO

Using our Investing Best Practices we will build a strategic portfolio, globally diversified, designed to:

- Reach your goals

- Within your risk tolerance and

- Time frame

Most advisors stop here leaving risk "handled" only with Time (ride out storm) and Diversification (mostly bonds).

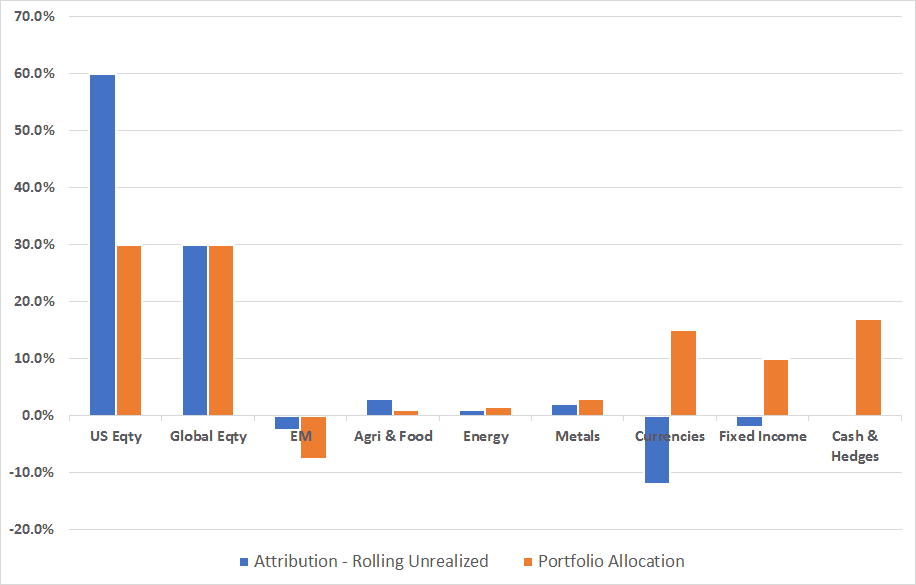

2. HEDGE STRATEGY

We then tactically mitigate the downside when most advantageous and stand back when all clear.

- Cut (or eliminate) negative drawdowns

- Reduce time to breakeven

- Elevated launch-point for subsequent recovery

- Enhanced flexibility to seize opportunity when others panic

Convert Problem of Drawdowns

Into Opportunity

All-Weather Plan

So You Can Relax

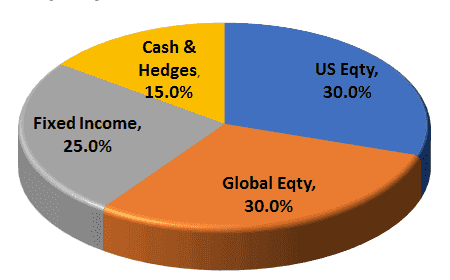

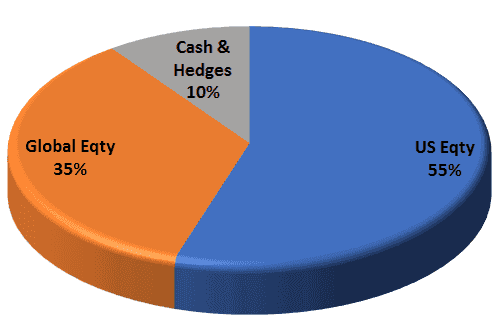

INVESTMENT PORTFOLIOS

Managed on your behalf, we offer key portfolios that are fully scalable to satisfy your needs. All contain our Dynamic Hedge Strategy.

Diversified Portfolios + Hedge

Strategy = Smarter Investing